By National Cybersecurity Alliance

Gift cards make for easy, versatile gifts, especially during the busy holiday season. But they’re also prime targets for scammers who use "gift card draining" to steal funds before the recipient can even use the card. Let’s break down how these scams work and how you can stay safe.

Read more >

[Posted 12/17/25]

By National Cybersecurity Alliance

Scammers prey on your kindness and often take advantage of tragic disasters. Here’s how to donate safely and protect your money.

Read more >

[Posted 12/3/25]

By U.S. Postal Inspection Service

The winter holidays are a time for everything nice. But criminals and their scams can cost you a hefty price. These Scrooges target consumers with phishing and smishing scams, and brushing and quishing schemes. And they can’t wait to take advantage of the giving spirit by stealing mail and packages.

Read more >

[Posted 12/1/25]

By BCP Staff

Online safety starts with protecting your kids’ devices from hackers and scammers.

Here are some steps to keep kids safer while they’re on a phone, tablet, or laptop. Consider taking these steps on your kids’ behalf and, as they get older, teaching them how to secure their devices and build good online habits.

Read more >

[Posted 11/24/25]

By BCP Staff

You get an unexpected call with some bad news: your name is linked to serious crimes, and your money is at risk, says the voice on the line. The next thing you know, he connects you with an “agent” who can supposedly help you resolve the issue. Your heart and mind are racing. But your gut is telling you to talk to someone you trust — or to get off the phone and search the internet for advice. So why would a helpful “agent” warn you not to talk to anyone or tell you to stay off the internet until he can fix the problem? Probably because that “agent” is really a scammer.

Read more >

[Posted 11/20/25]

By National Cybersecurity Alliance

Watch out for online shopping scams around the holiday season!

We want to help you protect your hard-earned cash from the scammers and hackers that pop up every year. It's like they don't care about the naughty list!

Read more >

[Posted 11/19/25]

By Federal Trade Commission

Scammers tell lots of different stories to try to get your money or personal information. They might lie and say you owe the government money. Or pretend to be your bank and say your account’s been hacked. They might claim someone in your family had an emergency or that your computer has a virus. Or they might tell a different lie.

Read more >

[Posted 11/18/25]

By National Cybersecurity Alliance

Being online today is now a daily routine for most of us, no matter your age.

Read more >

[Posted 11/5/25]

By National Cybersecurity Alliance

Social Security scams are one of the most common and costly forms of fraud targeting Americans today.

Read more >

[Posted 11/5/25]

By Federal Trade Commission

There are lots of ways to protect your personal information and data from scammers. But what happens if your email or social media account gets hacked? Here are some quick steps to help you recover your email or social media account.

Read more >

[Posted 10/29/25]

By National Cybersecurity Alliance

There are a lot of myths flying around about cybersecurity. We’ll go over the most common cybersecurity myths and debunk them so we can stay safer online.

Read more >

[Posted 10/23/25]

By Federal Trade Commission

Recognizing these common signs of a scam could help you avoid one.

Read more >

[Posted 9/30/25]

By National Cybersecurity Alliance

Passwords are the keys to safeguarding your digital and online life. They are your first line of defense. And knowing how to create and store strong passwords is one of the most critical aspects of everyday cybersecurity.

Read more >

[Posted 9/30/25]

September 30, 2025

By BCP Staff

Every year, scammers get more active around Medicare Open Enrollment Period, trying to get your money, information, or both. As you consider your health coverage and prescription options during this period (October 15-December 7), learn to spot the scams.

Read more >

September 8, 2025

By BCP Staff

A voicemail from an unknown caller reminding you about a $52,000 loan that you didn’t apply for can throw you off balance. Which explains why scammers send them — hoping you’ll respond first and think later. You might already know how to spot phone scams, but in case you need a refresher, here’s how to spot this one.

Read more >

September 3, 2025

By American Bankers Association

WASHINGTON —

As artificial intelligence (AI) continues to evolve, so do the tactics of scammers who exploit this technology to deceive and defraud consumers. Today, the American Bankers Association Foundation and the Federal Bureau of Investigation released a new infographic aimed at educating the public about the growing threat of deepfake scams.

Read more >

By BCP Staff

Do you feel like you’re getting more emails from strangers than messages from people you actually know? These unexpected messages are often phishing scams trying to steal your money and personal information. FTC data shows that email was the top method scammers used to contact people in 2024. To help you avoid these scams, here’s what to know.

Read more >

Aug 11, 2025

By BCP Staff

While scrolling through social media, you might come across a video or post discussing an “opportunity” to make money using checks. The problem? That advice could get you in trouble.

Read more >

Aug 7, 2025

By BCP Staff

Scammers posing as government agencies or well-known businesses are increasingly going after retirees’ life savings. They weave a web of lies about some bogus crisis. Then they trick older adults into giving them tens or even hundreds of thousands of dollars.

Read more >

Aug 4, 2025

By BCP Staff

Scammers are still pretending to be the police, calling to say you’ve missed jury duty and need to pay. But in a new twist, some scammers are now telling you to visit a website to enter your personal information — all so they can steal it and your money.

Read more >

July 28, 2025

By BCP Staff

Having a lot of debt can be stressful at any age. But if you’re retired or about to live on a fixed income, paying off debt can sometimes be more challenging. As you explore your options, know that scammers might promise to take away your debt — for a fee. If you pay them before they help you, you’ll likely lose money instead of getting a fresh start. So, what’s the best way to pay down debt while avoiding scams?

Read more >

July 27, 2025

By Kevin Williams

QR codes were once a quirky novelty that prompted a fun scan with the phone. Early on, you might have seen a QR code on a museum exhibit and scanned it to learn more about the eating habits of the woolly mammoth or military strategies of Genghis Khan. During the pandemic, QR codes became the default restaurant menu. However, as QR codes became a mainstay in more urgent aspects of American life, from boarding passes to parking payments, hackers have exploited their ubiquity.

Read more >

Apr 21, 2025

By National Cybersecurity Alliance

While you can’t use the internet completely undetected, you can manage your digital footprint and protect your data privacy. Find out more using our guide.

Every click, post, and account sign-up leaves a trace online, along with almost everything else you do on the web. These small bits of information can be used to learn more about you than you realize, especially when added together. We call this your "digital footprint" – the trail of data you leave behind as you navigate the internet.

Read more >

June 10, 2025

By BCP Staff

When it comes to protecting your identity, you might think about keeping usernames to yourself, using strong passwords, and reviewing your statements. That’s all great. But it’s also important to think about what you do with documents or digital files that contain your financial information. So, let’s look at what you should keep and lock up, and what you should shred or delete.

Read more >

June 23, 2025

By BCP Staff

If you want to use your driver’s license to fly, you’ll need a REAL ID. If you don’t have one yet, your state’s Department of Motor Vehicles (DMV) is the place to go, and they’re only taking in-person appointments. But people are telling the FTC that scammers are pretending to be the DMV or another government agency. Reports say these “officials” are sending messages saying you can skip the line if you pay or give them information. Here’s how that scam works so you can avoid it.

You get an unexpected text or email from someone who says they’re from the DMV or the Department of Homeland Security. They say you can skip the line and expedite your application for a REAL ID. You just have to click a link to share your information and pay, they say. But this is a phishing scam to steal your money or info.

Read more >

June 6, 2025

By BCP Staff

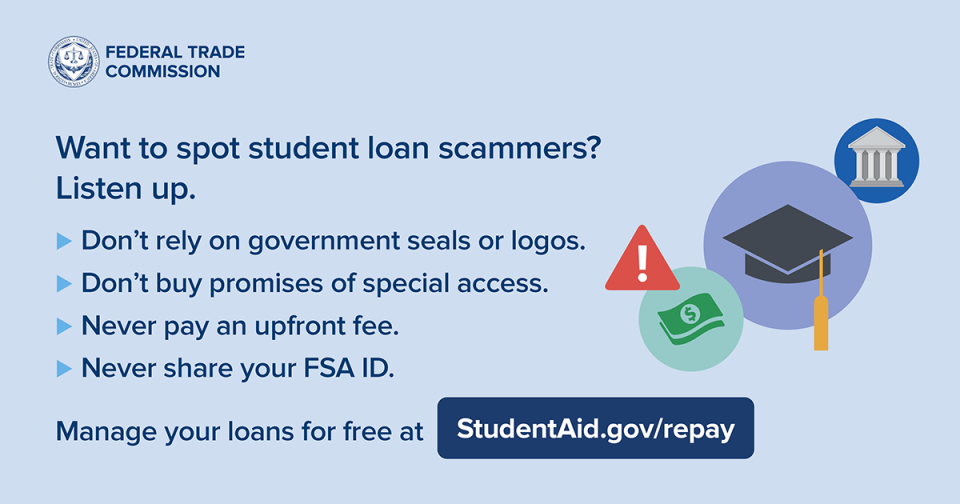

Paying off student loan debt takes time. That’s why getting a call from someone who says they can help you get your loans forgiven now (for a fee) might sound appealing. Is it really relief or just a scam?

It’s illegal for anyone to charge fees before they help you or to pretend they’re affiliated with the Department of Education. For example, the FTC settled a case against Panda Benefit Services (also doing business as Prosperity Benefit Services) and its affiliated companies and operators for allegedly using these tactics to trick consumers into paying hundreds to thousands of dollars in illegal upfront fees — to the tune of more than $16.7 million. The FTC charged that instead of helping people manage their student loan debts, the defendants pocketed the money and left people deeper in debt. Thanks to the FTC’s action, these companies are now banned from the debt relief industry.

Read more >

May 27, 2025

Whether you're lounging on a beach or hiking through the mountains, these days, you probably stay connected during your trip.

From snapping vacation selfies to booking hotels on the go to discovering five-star restaurants, travel and tech go hand in hand.

Unfortunately, cybercriminals know this, too. No matter whether your bags or packed or not yet, read on for some simple vacation online safety tips to protect your devices, data, and peace of mind while on vacay mode.

Read more >

May 19, 2025

By BCP Staff

Older adults may come from different backgrounds, but one thing they have in common is wisdom gained from life experience. This Older Americans Month, whatever your age, the FTC encourages you to share your wisdom about avoiding scams and fraud with the older adults in your life.

Pass It On, the FTC’s fraud education campaign for older adults, has clear, direct advice about more than a dozen fraud topics. At ftc.gov/PassItOn, you can read articles online or download resources, like activity sheets and bookmarks, and watch videos about scams that target older adults. Thousands of community organizations have already shared these materials, helping protect people across the country. So, spread the word, guard yourself against fraud, and help others do the same in celebration of Older Americans Month.

Read more >

Alert Number: I-091223-PSA

The FBI is warning the public of a recent nationwide increase in "Phantom Hacker" scams, significantly impacting senior citizens. This Phantom Hacker scam is an evolution of more general tech support scams, layering imposter tech support, financial institution, and government personas to enhance the trust victims place in the scammers and identify the most lucrative accounts to target. Victims often suffer the loss of entire banking, savings, retirement, or investment accounts under the guise of "protecting" their assets. Between January and June 2023, 19,000 complaints related to tech support scams were submitted to the FBI Internet Crime Complaint Center (IC3), with estimated victim losses of over $542 million. Almost 50% of the victims reported to IC3 were over 60 years-old, comprising 66% of the total losses. As of August 2023, losses have already exceeded those in 2022 by 40%.

Read more >

April 24, 2025

Alert Number: I-042425-PSA

The FBI is warning the public that cyber criminals are targeting users of employee self-service websites owned by companies and government services. The cyber criminals are using search engine advertisements to impersonate legitimate websites and steal victim information and funds.

Cyber criminals use fraudulent search engine advertisements to direct users to malicious websites that mimic the legitimate sites in appearance, but steal login credentials and other financial information when the victim logs in. Previously, cyber criminals primarily targeted small business commercial bank accounts in account takeover schemes, but have expanded to target payroll, unemployment programs, and health savings accounts with the goal of stealing money through fraudulent wire transactions or redirecting payments.

Read more >

April 18, 2025

Alert Number: I-041825-PSA

The Federal Bureau of Investigation (FBI) warns the public about an ongoing fraud scheme where criminal scammers are impersonating FBI Internet Crime Complaint Center (IC3) employees to deceive and defraud individuals. Between December 2023 and February 2025, the FBI received more than 100 reports of IC3 impersonation scams.

Read more >

April 10, 2025

By BCP Staff

Kids and video games often go together like peanut butter and jelly. Here’s something else that goes along with some video games: Ads competing for your kid’s attention at every stage of their video game-playing experience — while they look for video games on the app store, while they select and download games, and during gameplay. Learn how to deal with ads that encourage kids to spend money — sometimes without your knowledge or approval.

Some kids’ video games say they’re ad free…but they’re not. Next thing you know, your kid starts seeing ads for things to buy to unlock additional game features. Or maybe you pay for a game subscription thinking it’ll give your kid full access to the game. Except while playing the game, they see ads for parts of the game they can only get to if they click. What the game might not make clear? Each click is a payment.

Read more >

April 2, 2025

Alert Number: I-040225-PSA

The FBI is warning the public about criminal actors stealing US taxpayer identities to file false tax returns and fraudulently claim refunds. The FBI's Internet Crime Complaint Center (IC3) has received over 1,000 complaints about identity theft in connection with tax returns within the past year representing a 26% increase from the previous year. Stolen refunds are often redirected by criminal actors to accounts or addresses they control, including bank accounts, prepaid debit cards, mail drops and/or third-party accounts.

Read more >

April 3, 2025

By BCP Staff

Online search results can offer significant benefits to consumers, helping people find what they’re looking for. But online search results are also used by scammers to steer you in the wrong direction.

In fact, scammers sometimes use paid search results to trick you. They might use another company’s name, include the name of a government service, or use misleading tag lines to make you think you’re dealing with someone else. They might even put their number alongside a trusted company’s name or link to a website that looks official to steer you away from the business or government agency you were looking for. Their goal is to get your money or your personal or financial information to steal your identity.

Read more >

Online Safety and Privacy

You can protect your online accounts with more than just a password.

Multifactor authentication (MFA) adds another layer of protection—think of it like securing your front door with both a deadbolt and a keypad lock. MFA is a simple, effective way to keep hackers out, even if they manage to get your password.

Read more >

Online Safety and Privacy

Cybercriminals love to go phishing, but you don't have to get hooked.

Phishing is when cybercriminals use emails, social media posts, or direct messages to trick you into clicking harmful links or downloading malicious files. Phishing is a common "social engineering" attack in which a hacker attempts to deceive you instead of directly attacking your system. Falling for a phishing scam can expose your personal information, like passwords or credit card numbers, and can even result in cybercriminals installing malware on your device.

Read more >

Online Safety and Privacy

Keeping your information private is a challenge, and in many cases, you might not have a choice. But there are tech tools now available that are in your corner. From private browsers to data removal tools and all-in-one privacy suites, these programs let you take back some control of your digital footprint.

Read more >

March 13, 2025

Scammers tell all kinds of stories to try to get your money or information. They might call, pretend to be from a government agency, and say you owe a fine. Or they may pose as a friend or love interest online who supposedly needs money for an emergency. A scammer might offer you a (fake) job, but say you need to pay a fee before you get hired. Or they might tell a different lie.

Read more >

March 6, 2025

On National Slam the Scam Day and throughout the year, recognize Social Security-related scams and stop scammers from stealing your money and personal information.

Read more >

Cybersecurity for Tax Season: Protect Your Identity and Refund

Tax season brings enough stress without adding scammers to the mix. But the reality is that criminals ramp up attacks in the first few months of the year, often impersonating the IRS or trusted services like H&R Block and TurboTax.

By adopting smart security habits, you can protect your data and ensure your tax refund goes where it belongs—your bank account.

Essential cybersecurity tips for tax season

1. File your taxes early.

Here's our top tip for tax time cybersecurity: file your taxes as soon as possible. Filing quickly reduces the risk of tax fraud. A common scam is for criminals to try to submit fraudulent tax returns using stolen Social Security numbers to claim refunds. Employers must send out W-2s and 1099 forms by January 31, so once you have your documents, don’t delay. If a criminal files before you do, reclaiming your refund is a lengthy and stressful process. If you are in this situation, contact the IRS as soon as possible.

Read more >

Online Safety and Privacy

Online scams are becoming increasingly sophisticated, targeting people of all ages. But with some knowledge, you can protect yourself and your loved ones.

Scammers stay scamming

Preventing a scam is easier than getting money back after a scam. Here’s a quick guide to some of the most common scams out there today:

Read more >

After extreme weather and disasters like hurricanes, wildfires, and tornadoes, you might need to quickly hire someone for rebuilding or repairs. Before you do, know how to avoid unlicensed contractors and scammers that promise to help, but leave you worse off.

Read more >>

You want your donations to count, so it’s important to do some research before giving to a charity. Here are some things you can do to learn more about a charity and avoid donating to a scam.

Read more >>

If it’s not scammers spamming your phone with texts or filling up your inbox with emails, it’s your mailbox crammed with ads and other mail you didn’t ask for. The junk messages and mail might seem endless, but there are some ways to help scale it back.

Read more >>

January 17, 2025

Andrew Rayo, Consumer Education Specialist, FTC

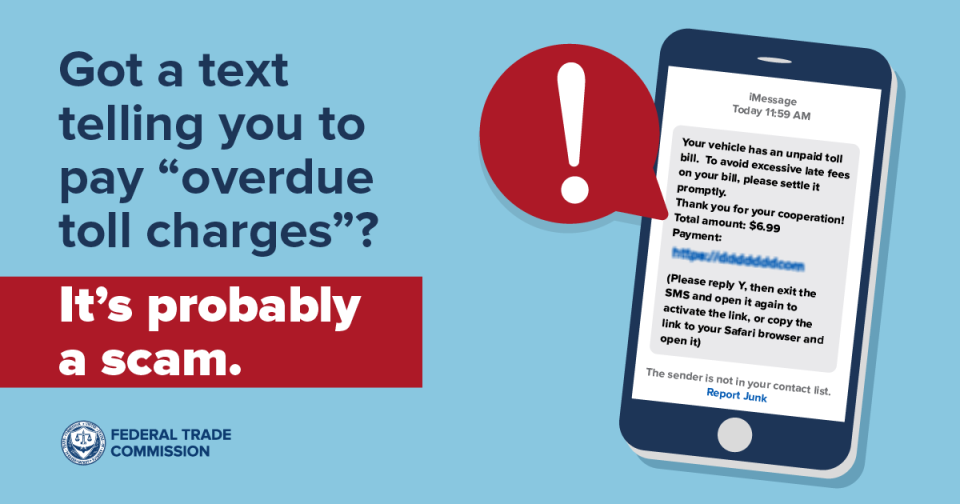

Whether you’ve driven through a toll recently or not, you might’ve gotten a text saying you owe money for unpaid tolls. It’s probably a scam. Scammers are pretending to be tolling agencies from coast to coast and sending texts demanding money. Learn how the scam works so you can avoid it.

You get a text out of the blue that says you have unpaid tolls and need to pay immediately. The scammy text might show a dollar amount for how much you supposedly owe and include a link that takes you to a page to enter your bank or credit card info — but it’s a phishing scam. Not only is the scammer trying to steal your money, but if you click the link, they could get your personal info (like your driver’s license number) — and even steal your identity.

Read more >

January 27 – 31, 2025

Data Privacy Week is an international effort to empower individuals and businesses to respect privacy, safeguard data and enable trust.

2025 Theme

You have the power to take charge of your data. This is why we are excited to celebrate Data Privacy Week 2025 with the theme:

Read more >

Online Safety and Privacy

You can be a target of credit card skimming when you least expect it.

One moment, you might be filling up on gas or withdrawing some cash from an ATM. You go about your day but later learn that criminals stole your card details and are racking up charges. While card technologies are improving, we must stay informed about the latest credit card scams, because scammers always look for ways to overcome security improvements.

Read more >

December 11, 2024

Ari Lazarus, Consumer Education Specialist, FTC

Scammers love a good disguise. One day they show up texting you about a delivery you missed, the next they say you need to sort an issue with your Netflix account. Here’s how to avoid these phishing scams.

Phishing emails and text messages often tell a story to trick you into clicking on a link or opening an attachment. Maybe it’s an unexpected email or text message pretending to be from a company you know or trust, like a utility company asking you to make a payment. Or maybe it’s an unexpected party invitation that looks like it’s from a friend or family member.

Read more >

December 4, 2024

Online Safety and Privacy

Gift cards make for easy, versatile gifts, especially during the busy holiday season. But they’re also prime targets for scammers who use "gift card draining" to steal funds before the recipient can even use the card. Let’s break down how these scams work and how you can stay safe.

Read more >

Online Safety and Privacy

Online shopping may be convenient but it can present many opportunities for scammers and cybercriminals.

For many people, online shopping is simply “shopping.” Who can resist one-click ordering and next-day delivery? However, bad actors and cybercriminals may try to trick consumers into paying for goods that don’t exist or seek to capture personal information for financial gain.

You don’t need to abandon your cart, though. With some simple preventative measures, you can enjoy your online shopping spree with peace of mind.

Read more >

December 3, 2024

Alert Number: I-120324-PSA

The FBI is warning the public that criminals exploit generative artificial intelligence (AI) to commit fraud on a larger scale which increases the believability of their schemes. Generative AI reduces the time and effort criminals must expend to deceive their targets. Generative AI takes what it has learned from examples input by a user and synthesizes something entirely new based on that information. These tools assist with content creation and can correct for human errors that might otherwise serve as warning signs of fraud. The creation or distribution of synthetic content is not inherently illegal; however, synthetic content can be used to facilitate crimes, such as fraud and extortion.1 Since it can be difficult to identify when content is AI-generated, the FBI is providing the following examples of how criminals may use generative AI in their fraud schemes to increase public recognition and scrutiny.

Read more >

December 2, 2024

Ari Lazarus, Consumer Education Specialist, FTC

During the holiday season, you might expect to get more deliveries. Some might even be surprise gifts. Scammers are counting on that when they send fake delivery notifications to you by email and text, hoping you’ll click. Here’s how to spot these scams.

You get an email or text and it says you missed the delivery. Or it might say your item can’t be delivered because you need to update your street address or zip code. Sometimes these scammers create a sense of urgency by saying if you don’t respond right away, they'll return your package to the sender. The scammers say both of these issues can easily be fixed: just click on a link.

Read more >

November 26, 2024

Amy Hebert, Consumer Education Specialist, FTC

There’s no shortage of good causes to donate to this holiday season. But before you give somewhere new, make sure you’re not donating to a scam.

Scammers are pros at tricking people into donating. They’ll often even use names that sound a lot like other charities you’ve heard of to get your money. Here’s how to make sure your money is going to support the cause you care about:

Read more >

November 1, 2024

Before you buy something online, shop around and check out sellers and products. Also, keep records of purchases, like receipts and emails, to make sure you’re able to hold a seller to its promises.

Read more >>

October 29, 2024

Alvaro Puig, Consumer Education Specialist, FTC

Hackers target your email and social media accounts to steal your personal information. Like your username and password, bank or credit card account numbers, or Social Security number. If they get it, they use it to commit identity theft, spread malware, or scam other people. So, what are signs that someone hacked your account, and how can you recover a stolen account?

Read more >

September 11, 2024

Cybersecurity Awareness Month is an international initiative that educates everyone about

online safety and empowers individuals and businesses to protect their data from cybercrime.

Read more >>

September 11, 2024

Imagine carrying a written copy of all your conversations with you everywhere you went. Or copies of your account numbers, usernames, and passwords. Or all the photos and videos you’ve ever taken. I bet you’d do just about everything in your power to protect all that valuable information. Well, your mobile phone holds all that stuff — and maybe more. Are you doing everything in your power to keep it from ending up in the wrong hands? Here are three things you can do today to protect the personal information on your phone.

Read more >>

August 15, 2024

In August 2024, a new class action lawsuit claimed that every American’s Social Security number was stolen in a data breach that occurred in April 2024.

The lawsuit says that hackers stole the personal information of 3 billion people, including every existing Social Security numbers, from background check company National Public Data (NPD). If true, this would mean every American is at risk of having their identity stolen.

Read more >

August 23, 2024

Alvaro Puig, Consumer Education Specialist, FTC

We’re living in the data age. The things we do on our phones and computers, on our internet-enabled smart devices, and on websites leave a trail of our activities and our personal information. That personal information has value — not just to us, but to scammers and hackers who want to steal our identities. Here are five things you can do to keep scammers and hackers at bay.

Read more >

July 8, 2024

Terri Miller Consumer Education Specialist, FTC

Did someone supposedly spot fraud or criminal activity on one of your accounts? Did they offer to help “protect” your money by moving it from your bank, investment, or retirement account? Maybe they even asked you to share a verification code? If anyone did any of those things, it’s always a scam. So, what do you do next?

Read more >

June 28, 2024

Ari Lazarus, Consumer Education Specialist, FTC

Some student loan debt relief companies will lie and say they’re affiliated with the Department of Education when they’re not. They want their bogus claims of “guaranteed” loan forgiveness (for a fee) to seem more legitimate (they’re not).

Read more >

Terri Miller, Consumer Education Specialist, FTC

When you log into your bank or credit card account, you might get a text message or email with a verification code. You then enter it at the login screen to confirm it’s really you. That’s a form of two-factor authentication that adds a layer of security to your account — and keeps would-be scammers and hackers out.

Read more >

Colleen Tressler, Consumer Education Specialist, FTC

Imposter scams often begin with a call, text message, or email. The scams may vary, but work the same way – a scammer pretends to be someone you trust to convince you to send them money or share personal information.

Read more >

April 16, 2024

Terri Miller, Consumer Education Specialist, FTC

Hearing a lot about federal student loan forgiveness in the news? You’re not alone — scammers are, too. You might get a call from someone saying they’re affiliated with Federal Student Aid (FSA) or the Department of Education. (They’re not.) They’ll say they’re following up on your eligibility for a new loan forgiveness program, and might even know things about your loan, like the balance or your account number. They’ll try to rush you into acting by saying the program is available for a limited time. But this is all a scam. What else do you need to know to spot scams like this?

Read more >

March 7, 2024

Alvaro Puig, Consumer Education Specialist, FTC

One way to spot a scam is to understand its mechanics. A new and complicated scam starts with a call or text message about a suspicious charge on your Amazon account. But it’s not really Amazon. It’s a scammer with an elaborate story about fraud using your identity that ends with you draining your bank or retirement accounts.

Read more >

February 27, 2024

Cristina Miranda, Consumer Education Specialist, FTC

If you’re in the checkout line with a gift card (or several) in your hand, ask yourself: is the gift card you’re buying for a gift? Or is someone on the phone with you as you’re checking out telling you what to do – like buy a gift card to pay for something and give them the numbers? Gift cards are ONLY for gifts. That means if the gift card isn’t for someone’s birthday, anniversary, or for any other gift giving reason, it’s a scam.

Read more >

February 14, 2024

Bridget Small, Consumer Education Specialist

When you have a new romance there’s so much to talk about. But if your new sweetheart only wants to talk about your money and how you should invest it, stop talking. They might be a romance scammer, like those who stole more than $1 billion from people last year. How do the scams start, and what can you do to avoid one?

Read more >

National Cybersecurity Alliance

Data privacy might seem abstract, but it couldn’t be more personal. You generate lots of data every time you access the internet, and sometimes, when you don’t – your home address, health records, and Social Security are all pieces of data. While you can’t control the fact that your data is collected, you can take charge of how and with whom you share data with in many cases.

Read more >

If you have a cell phone, you probably use it dozens of times a day to text people you know. But have you ever gotten a text message from an unknown sender? It could be a scammer trying to steal your personal and financial information. Here’s how to handle and report unwanted text messages.

Read more >